How to Value NFTs - When to Buy and Sell an NFT for profit or minimizing loss - How to Read NFT charts - Look for Patterns

How to NFTs - When to Buy and Sell an NFT for profit or minimizing loss - How to Read NFT charts - Look for Patterns

"Participants are more incentivized to sell, rather than to hold. We need to get to a place where participants are more incentivized to hold, rather than sell."

Most people who are buying and selling NFTs are doing so to try to make money. Many of these people are called flippers. Flippers can buy and sell an NFT within minutes, hours, days or months.

Knowing when to buy and when to sell is very important if you want to make money in NFTs. Some people buy and never sell, or buy and hold for long term and only sell many years later.

This section is focused on buying and selling for quick profits aka flipping NFTs.

Getting into NFTs it is important to know your tools. Before even talking about tools, you must have absolute control of your safety. Make sure to store high valued NFTs on a hardware wallet. Use burner wallets for minting new NFTs, etc. Check out this summary for NFT safety.

Back to the list of tools for researching NFTs. There are many free or paid NFT analysis tools. Research and try them all out to see what fits your needs. Not all tools analyze the same information.

Timing an NFT buy and sell - When to Buy and Sell and NFT - Watching for Patterns

NFTs often only have a fixed limited supply. 1 of 1s only have 1 of that item. PFP collections often have roughly 10,000 NFTs in the collection. This is a relatively small number relative to the number of participants in popular NFT projects. When demand is higher than the supply listed for sale, then price can quickly pump. This often happens near the launch of a new NFT project shortly after minting (launching).

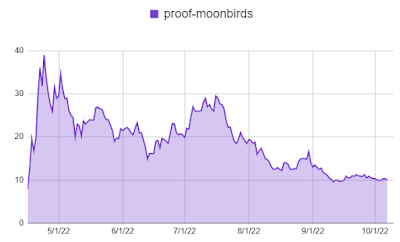

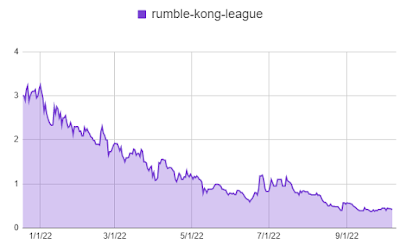

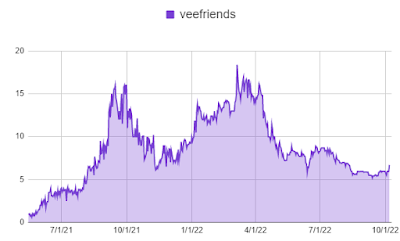

Take a look at the different patterns from some NFT projects. This is based on a longer time frame, but these can also work for shorter time frames.

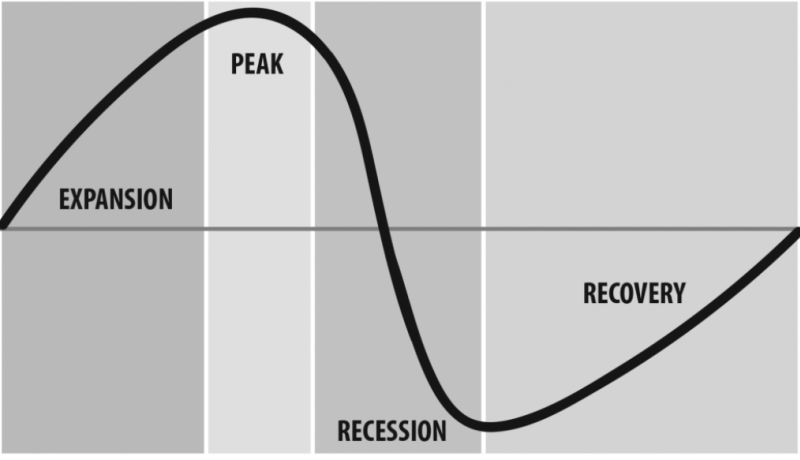

Valuing NFTs Like Real Estate - NFT cycles liken to Real Estate Cycles

NFTs work just like any other market. There are boom and bust cycles in NFTs. The NFT cycle works a lot faster than a Real Estate cycle. A typical real estate cycles can take on average 10 years. A NFT cycles can complete in as long as 1 year or as short as 1 day.