How to Sell an NFT - Step by Step - What price should I Sell my NFT?

So the price of your NFT has gone up and it looks like a good time to sell. But how do you determine how much to sell your NFT for? How do you determine what price to set for selling an NFT?

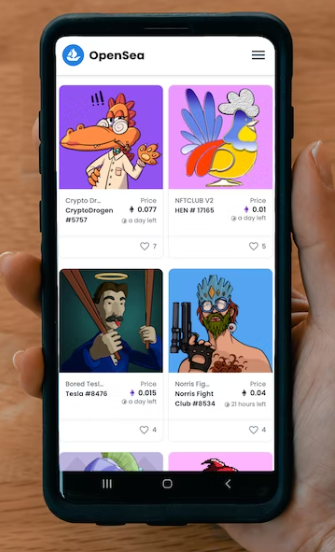

Some things to consider are the rarity of your NFT and if it has any special attributes or utility that others in the collection don't have or are more rare. If your NFT is from a collection, then start sorting prior sales from a secondary market place such as opensea.io. Once you filter some of the traits that your NFT has, you can sort by recent sales. This will give you an idea of how much some of the other NFTs in the collection have sold for recently. Another piece of information to look at is the past 30 days of sales. Are sale prices generally going up or down? If prices are going up, then you have more of a seller's market. That means demand is out pacing the supply. That means if you price your NFT above what others are selling for, you may have a good change of it selling. That will bring it a higher net profit in your pocket. If the opposite is true and prices are trending lower. It might be a good idea to price your NFT lower in order for it to sell. Pricing your NFT too high may cause it not to sell and you may be left holding the NFT that you dont plan on holding. Another technique is to price is competitively, but not below the floor price (floor price is the lowest priced NFT in the collection). You may get bids for your NFT which can help you sell faster, but normally bids will come in lower than floor prices, unless you have a more rare NFT or some trait that is highly sought after.

Another technique is to set a high price and set a long selling period, such as 6 months. If you are not in a rush to sell your NFT, you can use this technique to set it and forget it. Hoping that an eager buy will find your NFT or that prices will go up and meet the price that you set.

NFTs normally big spike in demand due to hype of fomo. So many times selling sooner rather than later is a better mentality to have when dealing with NFTs. As the market matures and there are more "grail" NFTs, then buy and never sell (hodl) method may work in the long run. But at it's infancy, if you want to guarantee your profits, it's probably safer to sell once you are in profit and happy with your gains.

At the end of the day, there is no right or wrong answer as to how much to list or price your NFT for sale. You have to be happy with the price you are selling it for and nobody will blame you for taking profits.

Buying multiples can help alieviate some of the price anxiety. This method if properly used can allow you to sell at multiple price points and at different times if the life of the collection.

For example, NFTs many times have 3 strong up movements. The initial pump from the mint price. Then there will be a small dip in price from people taking profits. Then once all the sellers have finished selling, if the demand is still there, then the price will pump up again. This time it could be equal amount or percent to the first pump. The there will be another dip and prices many times will take a dip and go back up. If prices go up for a 3rd time, this is normally the biggest pump which often times can double, triple or even quadruple the value of the NFTs. Depending on how long the price took to get to the peak, it can drop off a cliff or slowly come back down to some prior prices.

Being in tune and watching active sales can give you an idea of where the prices are going. Also watch the volume over minutes, hours and days. If there is significant volume still coming in with prices going up, then that's a good momentum for prices to continue upward. If there is significant volume, but prices are going down, then this may be a sign of many people existing and trying to get out of a project.

The last piece to look at is more on the fundamental side. It helps a lot to be in tune with what the team is doing with the project. This can be found on Twitter or if there is a Discord group. You may want to reach out to the team directly or some avid holders. Ask them why the believe in the project and what kind of time lines they are expecting. This will give you an idea how long you want to hold onto an NFT.

Most people who sell to soon, always have a bit of regret. But if you sell for a net profit, you should take it. The majority of NFT buyers will buy and hold for too long. Missing out on peak prices or even prices where you could have sold for a profit just makes holding much more difficult. As you watch the price of an NFT collection drop, you keep telling yourself it will go back up. Then days goes by and weeks go by, but the price keeps dropping. Then the feeling of regret will keep bothering you. Until you finally cave in and sell at a loss and regret not selling sooner.

The moral of the story is to sell when you are in profit. You may not sell at the peak every time, but if you want to stay in the game and keep growing your bank roll, then you need to learn to take profits. Holding NFTs is very dangerous. Too many projects/collections go basically to ZERO. You don't want to get left behind holding the worthless bags. SELL WHEN IN PROFIT. Or remember to take your losses and move on to the next project.